Yields are soaring and markets are puking. Oil and inflation joined the pummeling as well.

Remembering enjoying Labor Day BBQs after a “Goldilocks” job report that was just perfect? Investors felt a little better.

There were whispers of a calm September. September is usually an unhappy month for the markets.

So this was welcome news. Only 2 days ago, I thought maybe it is different this time.

That was then. Now we are back to this.

The plot twists in this market are coming from all sides. The latest gut punch to the market is oil prices, followed by the smack of rising yield curves, and a swift kick from services inflation. All this in 2 days!

Post-labor has not been fun if you are a market bull. It has been a bit nauseating and it looks like it is not getting any better from here. Let’s talk about:

🚨Yield: Higher on corporate demand and potential to rise

🛢️Oil: Saudis and Russians need money

🏪Services Inflation: Services inflation is a stubborn mule

🔮Where the Market Goes Next (and When)

Yields

Yields went up this morning as $36 billion of corporate debt flooded the market. Let me explain how this impacts the stock market.

The 10-year yield means many things to many people at the same time. The 10-year yield is a focus area of corporate loans and economic forecasts. Plus, changes here can indicate shifts in inflation expectations and investor confidence.

Yields can also go up if investors sell 10-year treasury bonds. Think of it this way, if I want you to lend me money, I would have to pay you a high enough rate for you to part with your money. Or to not look into other alternatives.

The other alternatives just stampeded into the market. Bond investors sold treasury bonds to purchase corporate debt. Treasuries sold-off and yields went up. And not only are they going-up, they are going to nose-bleed levels.

🚨 For the 3rd time this year, they are approaching a 16-year high.

High interest rates — as we all know — are poisonous for higher stock prices.

It is not going to get any better, over the next week corporations are expected to release a tsunami of bond issuance ahead of the Fed meeting on Sept. 19-20.

Oil

Russia needs higher oil prices. No secret there. Putin needs cash to finance his war machine. At $100/barrel (Brent Crude), he would be sitting happier.

But the real surprise here was the Saudis:

“This additional voluntary cut comes to reinforce the precautionary efforts made by OPEC+ countries with the aim of supporting the stability and balance of oil markets,” the Saudi Press Agency report said, citing an unnamed Energy Ministry official.

Stability for the Saudis that is.

America’s once favored friend, Saudi Leader Mohammed Bin Salman…

and his clan just curbed the supply of Saudi oil until the end of the year. The market expected a smaller reduction for a smaller time frame (about a month).

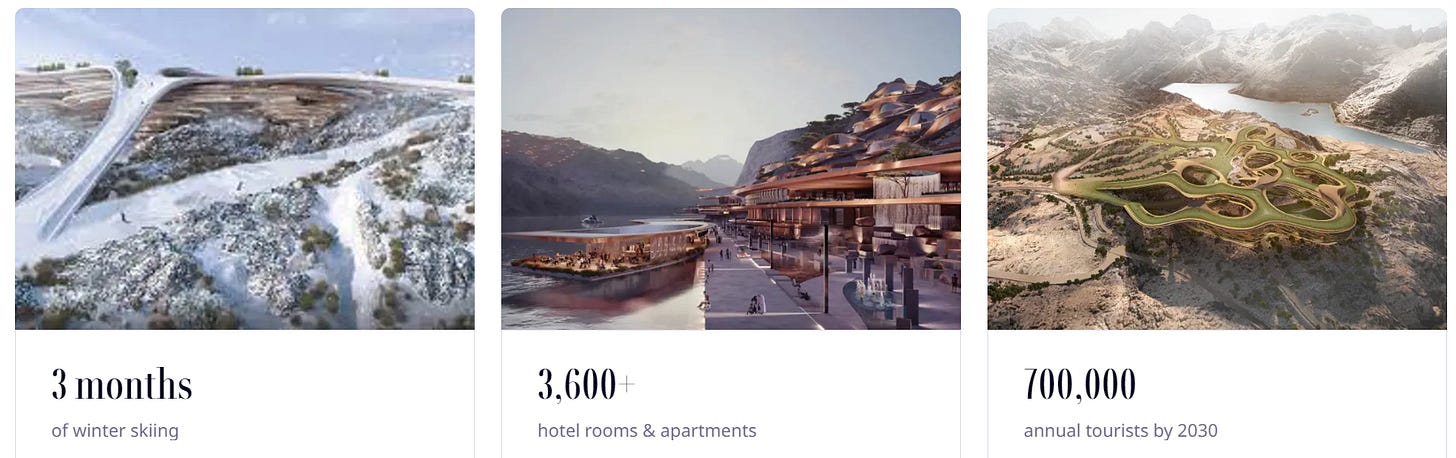

The Saudis need money to finance their visions of the future: Vision 2030. An ambitious plan to overhaul the kingdom’s economy and society. I don’t know if it is feasible, but it looks amazing and beautiful.

These projects are more ego than need. How much does ego cost? At least $2 trillion1.

The plan includes several massive infrastructure projects, including the construction of a futuristic $500 billion city called Neom.

What does a new city in the desert need? A mountain region, artificial lakes, and 30 kms of ski slopes of course.

Services Inflation

The Institute for Supply Management’s US services index rose to a six-month high in August — hitting 54.5. This exceeded expectations.

The Fed has said it is looking at the data for direction on future interest rate policy. In particular they are worried about labor, housing, services, and input prices (raw materials). They want these to slow down.

Only the labor (jobs) data indicated a chance of the Fed easing. It looks like we are swinging back to higher-for-longer rates mentality. Which means we are leaning toward a neutral to bearish market view.

Where the Market Goes Next

None of the news is good and will pressure markets in the short term. On the other hand, investors were still quite bullish in late August. Plus the majority of the economic data was been released over the last 2 weeks.

This sets the stage for a price tug-of-war until the FOMC meeting on Sept. 20th. Investor bullishness competing with the drag of high oil prices and corporate bond sales.

I mentioned before that the major indices are bouncing around their 50 day EMA (exponential moving average). It looks like we are going to keep bouncing above and below that level until FOMC.

The S&P is close to the level but could get to the mid-August level of 435. Another 2-3% down by Sept. 20th.

The Nasdaq could move down another 4-5% by Sept 20th.

One huge winner from all of this: Energy Stocks.

The perfect brew is there for energy companies in the next few months:

Higher Profit: Oil prices up

Higher Demand: Everyone travelling again

Less Supply: Cuts from Saudis and Russia. Lower reserves in US storage.

If you have any questions, leave a comment. Thanks for reading Embrace the Chaos! Sharing perspective that makes sense.

Much effort and research went into making this 5-minute read. If you found it valuable, please help me out by clicking the like button and sharing this article.

Sharing is caring!

- Vikas Kalra, CFA

From table in https://en.wikipedia.org/wiki/Saudi_Vision_2030

I love reading your reports, those are very informative...