Are Regional Banks Going to Get Crushed by a $1.5 Trillion Wall of Debt?

If it has a stripe, is it a zebra?

TL;DR: Some regional banks have commercial real estate loans and only some of those loans are for office buildings. Loans could get renegotiated or reworked. Some locations of the country are stronger than others. Deposits aren’t falling off a cliff.

Going into earnings season, headlines like this strike fear.

Doom. It just won’t stop.

What can we expect this earnings season?

Will it be difficult for many companies? Yes. Will companies have concerns about access to credit and look to contain costs? Probably. We will write about that next.

But what about the actual regional banks themselves? Is the banking system going to implode and drag down the economy? No.

Right now, most regional bank stocks are priced for dramatic immediate implosions (down 30%-70% last month). In a few weeks, commercial real estate (CRE) has become an unknown risk capable of torpedoing the system. Worse than 2008.

Is it difficult now? Yes. Worse than 2008? Not even close. Is CRE risk new? Not at all. It will not be dramatic, it will not be immediate, and it will not be most banks.

What about all the headlines? The headlines are Armageddon-inspiring because Armageddon is good clickbait. Groupthink has taken hold and everyone is cherry-picking data points that line up with the hysteria.

Why? It’s natural. Humans are hard-wired for fear. 😨

This is not to imply that as a group, regional banks are solid long-term investments. They will need to fight for deposits going forward and more loans are coming due in 2024.

Long term this will be a game of survival. We will learn more information during earnings to paint a better map of the banking wreckage.

The regional banks will have their time on the stand. Until then, remember, everything with a stripe is not a zebra. There will be winners.

What exactly would be a winner? Given the dark pessimism, any financial firm that can show they can survive without government aid could see a rebound in share prices. At least until a recession really shows.

The groupthink behavior and the collective selling of investors points to overblown fear and panic. We don’t know enough about every bank’s long-term prospects, but I do know we need the banking system. Without it we have no economy.

If the world is not ending, then regional banks are still worth considering. At a minimum it might pay to approach earnings season with a more balanced view and ignore all the hype.

Consider this:

Not every regional bank has large CRE holdings…

Banks do hedge risks. A bad apple does not mean everything is spoiled.

Commercial real estate does not = all large office buildings.

Banks and borrowers have the capacity and incentives to renegotiate. Some debt will get renegotiated.

Not all empty office space is a value of zero. Some office space will reconvert to residential or other uses.

Every financial institution was sold off. Not everything is a regional bank.

80% of CRE mortgages are held at banks outside the big, “too-big-to-fail” money centers. That is a good thing!

Despite what you heard, deposits are not falling off a cliff…

and are still healthy for now and money is shuffling around the banking system.

Share prices ALREADY reflect carnage.

The RIGHT bank shares are on sale

Dig in below to find out more 👇

Not every regional bank has large CRE holdings…

Not all banks have a huge exposure to commercial real estate.

Below is a list of the commercial mortgage exposure of the 48 bank with greater than $10 billion in assets where their exposure exceeds 200% of total equity capital. Data as of Dec. 31, 2022.

Other banks that have more manageable exposure should stay relatively safe. Plus, they can hedge or in other words buy insurance against known risks like changes in interest rates.

Banks do hedge risks. A bad apple does not mean everything is spoiled

Unfortunately for the regional banking sector, the worst of the lot is the benchmark for everyone outside of banking. Silicon Valley Bank was a bad actor (we discussed here). They failed to take reasonable steps to reduce the losses from changing interest rates. They failed to have a Chief Risk Officer (CROs) – it is a standard position.

Well managed banks have CROs who help guard against risks related to the changes in the financial landscape. They use tools widely available to all banks and financial institutions.

An example. I invested in a relatively unsophisticated private REIT and they bought interest rate insurance in November 2022. Knowledge of the risks tied to interest rates and commercial real estate was very obvious. Banks have been managing these…it is the very purpose of a bank. I think everyone needs a reminder that responsible banks do still exist.

The Fed and the FDIC even have programs to help banks deal with these risks. Clearly, there was an error in execution here and FDIC, Fed, and authorities are determining how the programs could have missed SVB. But one bad bank does not mean the entire banking system is teetering on disaster (Signature and Silvergate failed because of their unique crypto first business model).

Commercial real estate does not = all large office buildings

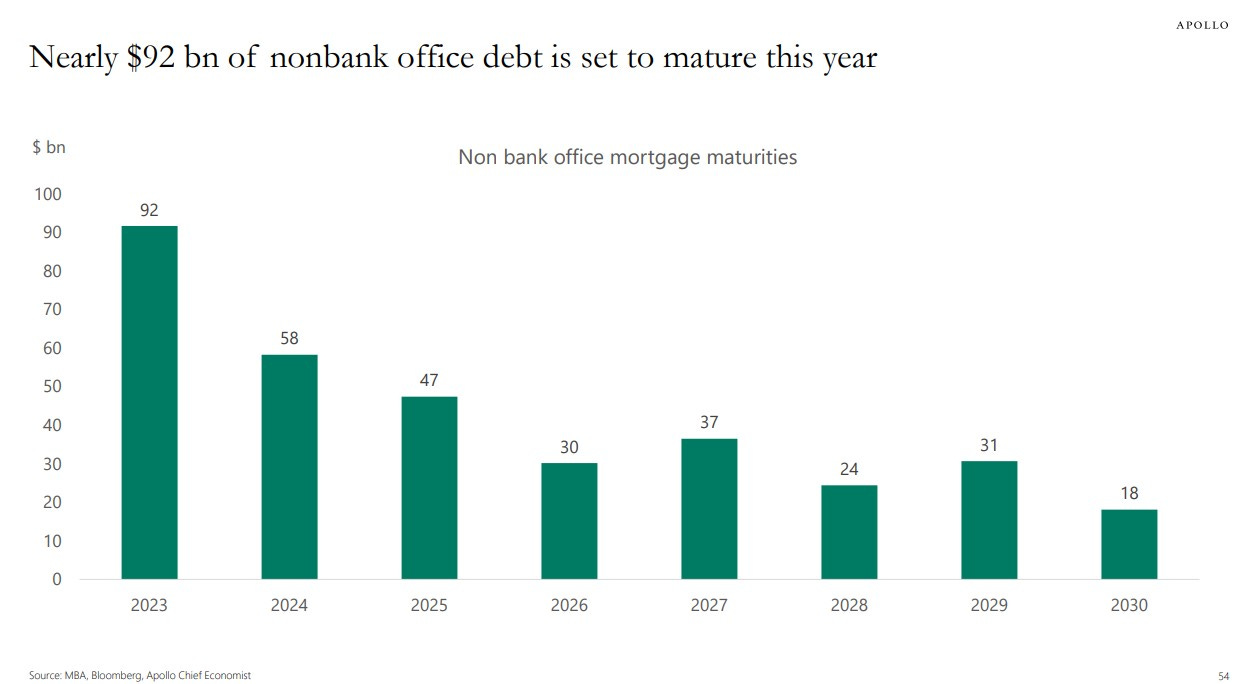

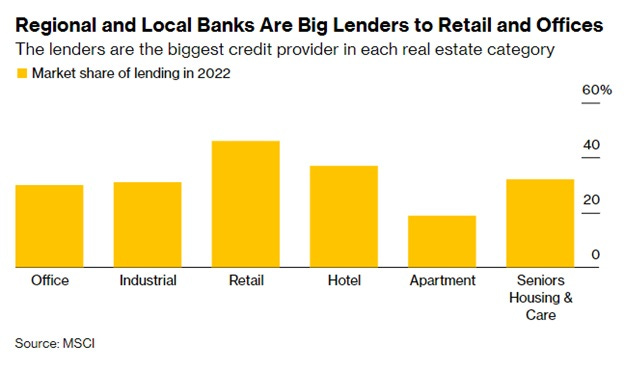

Commercial real estate includes several categories, including office space, hotels and resorts, strip malls, restaurants, healthcare facilities, multi-family rentals, and industrial space. Office space is 20% of the lending. It is only part of this 20% that is of concern.

Banks and borrowers have the capacity and incentives to renegotiate. Some debt will get renegotiated.

Some loans will sour and some certainly have. However, in the business of borrowing, when there is systematic danger for everyone, it pays everyone to renegotiate loans. Banks can get more money from clients who are not bankrupt. A quick google search will produce plenty of companies available to help renegotiate commercial loans.

Not all empty office space is a value of zero. Some office space will reconvert to residential or other uses.

Large cities are actively involved in building solutions to repurpose empty office space. They have no choice. They have to find ways to maximize rents, increase productivity, and create utility for their citizens. Here is an example of a project in New York and DC out of the mayor’s office to rezone space. It is adapt or die. I bet on adapt.

Every financial institution was sold off. Not everything is a regional bank.

Right now investors have dropped anything related to banking even if it is far removed from regional banking. Look at these stocks:

👉 State Street is a securities firm and an asset manager. Fell 15% in March.

👉 Bank of New York Mellon is “managing and servicing the investments of institutions and high-net-worth individuals. Its two primary businesses are Investment Services and Investment Management.” Fell 12% in March.

👉 Charles Schwab is one of the largest and most successful brokers in America and “offers banking, commercial banking, investing and related services including consulting, and wealth management advisory services to both retail and institutional client”. Fell 35% in March.

None of these are regional banks and all have plenty of cash and investors. But they all still fell. Why?

Because many fear they will need to sell bonds that they hold as investments just like SVB. Just because of this one stripe, the SVB comparison comes up. They are not remotely the same. Some depositors have moved money into different accounts in the same institution (e.g., investors moved money from Charles Schwab’s investment fund to its money market fund).

80% of CRE mortgages are held at banks outside the big, “too-big-to-fail” money centers. That is a good thing!

Are all regional banks going to fail? Are all their businesses exposed the same way? NO.

Real estate is regional. The economics are different from city to city. Regional real estate is not one big investment but a patchwork of smaller regional investments that all behave differently.

Look no further than the Fed’s own data. Emergency borrowing from the Fed has mostly flowed through the US central bank’s San Francisco branch. Other branches have not seen similar outflows.

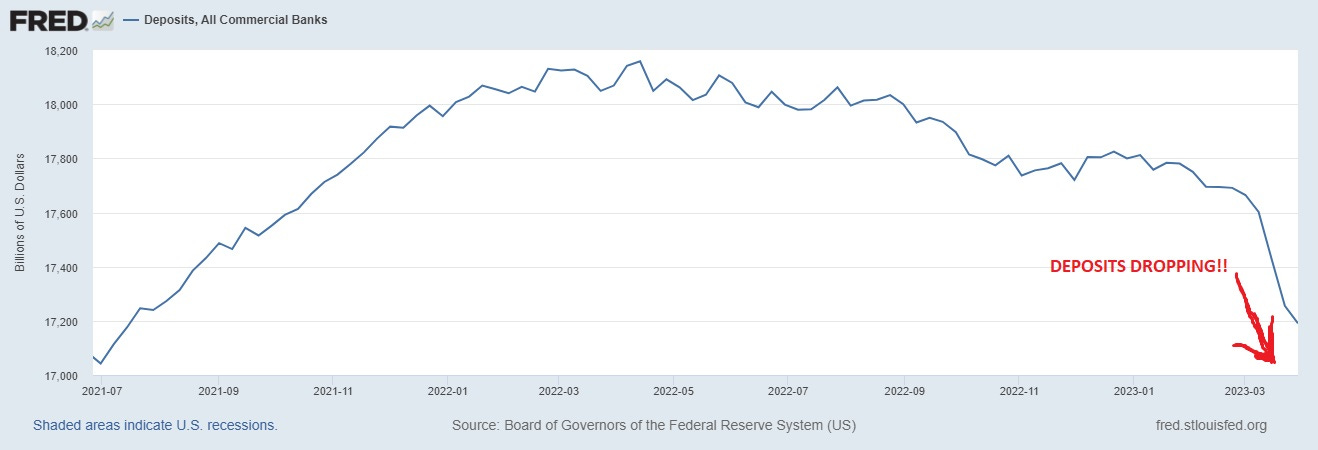

Despite what you heard, deposits are not falling off a cliff

It certainly seems that way. This is a popular chart on the internet.

Wow look at the money run away! This is what people really see:

The human mind loves filling in patterns. It is normal. The authors know it…they are doing it themselves.

If you zoom out the drop seems more like a blip. Especially when you think about all the excess cash flooding the system the last few years.

Now if we zoom closer in on the last few months, we see that the drop in ALL COMMERCIAL deposits has slowed down in the last week of March

But wait! This is ALL commercial deposits. What about the stampede out of SMALL commercial banks? In the last week of March, DEPOSITS INCREASED in SMALL banks! What happened to the exodus?

Deposits are still healthy for now and money is shuffling around the banking system

Many small businesses, including start-ups, are using solutions to protect all their money even if the FDIC doesn't increase the amount of insurance (set at $250k right now). American Deposit Management Company and IntraFi provide services that break up large cash deposits and distribute them in amounts of $250k or smaller to multiple banks. The solution is still to keep the money in the banking system.

Share prices ALREADY reflect carnage

If you are going to invest in a regional bank that is extending 400% of its deposits to San Francisco real estate, tech founders’ mortgages, and tech startups’ commercial loans, be worried.

But to take the word “regional bank” and, for example, use that as the reason to sell/misrepresent a well-managed regional bank in growing urban centers in the Southeast would seem a bit naïve and preposterous.

We are talking about two different species of banks here. Just because they both have stripes, both are not zebras.

A managing director at S3 partners, a financial data company focusing on short information best described the current state.

“Outsized short-selling like we saw in the banking sector are usually knee-jerk reactions to market turmoil and can reverse as quickly as they occur.”

The right bank shares are on sale

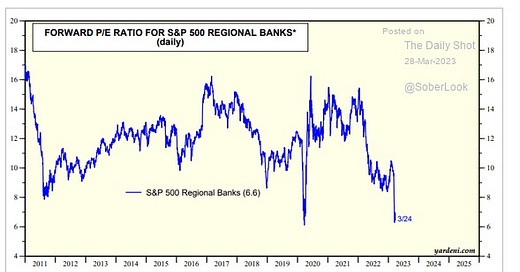

Beyond the COVID crisis, going back to 2011, they HAVE NEVER BEEN THIS CHEAP.

We will use the forward P/E to express the price of an investment which is the company price divided by forecast earnings. The forecast earnings come from analysts ratings.

A P/E around 15 is fairly valued. Anything over 20 is usually expensive. Here are the current values for the major sectors of the US economy.

Financials are expected to decline (from 14.11 to 11.49). But regional banks are expected to plummet…

Banks are at 6.6! They are cheaper than any other time in history except for COVID.

I leave you with a balanced analysis on why PNC and Fifth Third’s business is resilient. These stocks are down 30-40% in the last month when CRE loans are only 1.6% of PNC’s assets and 4.8% of Fifth Third’s assets.

At PNC, the $36 billion in commercial mortgages on the books of the bank is a small fraction of its $557 billion in total assets, including $321.9 billion in loans. Only about $9 billion of loans are secured by office buildings. At Fifth Third, commercial real estate represents $10.3 billion of $207.5 billion in assets, including $119.3 billion in loans.

And those loans are being paid as agreed. Only 0.6% of PNC’s loans are past due, with delinquencies lower among commercial loans. The proportion of delinquent loans fell by almost a third during 2022, the bank said in federal filings. At Fifth Third, only $10 million of commercial real estate loans were delinquent at year-end.