The fall of Silicon Valley Bank pushes the world to an altered trajectory. SVB was too big to fail and it failed.

But I wonder.

WHY DIDN’T THE INDUSTRY SEE THIS COMING and act earlier???!!!

This is the 2nd largest bank failure and the fastest bank failure in US history. What flawed thinking led us here? What happens next? This is a historic catalyst that will rewrite business and the economy.

Ultimately the combination of these vulnerabilities in a high rate environment destroyed SVB:

☠️ Not waiting for a better time

☠️ No communication strategy

☠️ Losses hiding behind an accounting rule

☠️ Concentrated customer base

On its own, each one of these was known and manageable. But together they were toxic and volatile.

We need to understand where we go from here and how to protect ourselves. To do that, we have to follow the road that got us here (if you already understand the SVB situation head to the last section):

What Is A Bank Run?

Why Is Silicon Valley Bank Important?

Mo’ Money, Mo’ Problems?

For a Moment Things Seemed Under Control…

And Then The Unexpected Happened…

Which Lead To The Unthinkable.

Let’s get to it. 👀 💸

What Is a Bank Run?

“It’s always been a matter of trust”

The One Asset to Rule All Assets

Finance at its core is a subjective measure of value and trust. Banks have various assets — dollars, and investments. Without trust, none of these matters.

The economic system is a web of trust where everyone trusts if we all act rationally, we will all be better off collectively. When someone gives you a dollar, you trust that others believe in its value. When you open a bank account, you trust you will get your 💵 back when you need it.

When we all believe the same fiction, it is true. But when trust erodes beyond a point, panic ensues. 👇

A Bank Run

🏃♂️🏃♂️ From Wikipedia: “A bank run occurs when many clients withdraw their money from a bank, because they believe the bank may cease to function in the near future.”

A better definition as it applies to SVB (and potential failures this week):

“A stressed state of affairs when trust is fragile, at an inopportune time, where a majority of like-minded and equally cash-strapped depositors demand their deposits at the same time from a bank, that trusted its customers would listen to pleas for “calm” after its own financial mismanagement.”

If you want to know what a bank run feels like, watch this 4 minute clip.

Why was Silicon Valley Bank Important?

“Services start-ups couldn’t get elsewhere”

This is a typical bank run that happened in atypical circumstances. And Silicon Valley was one-of-a-kind.

Founded over a poker game in 1983, Silicon Valley Bank became the go-to lender for tech startups were too risky for larger, more traditional banks. Eventually, Silicon Valley Bank would come to do business with nearly half of all U.S. tech startups backed by venture capitalists

It was a lender of last resort for many start-ups.

"If you're a high-growth startup, you can't get a credit card from a normal credit card provider, you can't get a loan from a big bank, but Silicon Valley Bank would give you that," Shelf Engine's Kalb said. "It's these services that startups couldn't get elsewhere."

Mo’ Money, Mo’ Problems?

“It's like the more money we come across, The more problems we see”

In 2021, SVB was raising oodles of cash and trying to find a home for it. With no loans to give, they stuffed nearly $100B into US treasuries and federally backed mortgage bonds. To be fair, at the time this was a prudent decision. There had been nothing safer and more boring than treasuries and federally backed bonds..

Banks borrow short and lend long. They get cash deposits from depositors (for the bank: liabilities) that are due at any time while investing in securities (for the bank: assets) that have fixed future maturities. The difference between these is net interest margin.

In 2021, the net interest margin was positive and churning out money. Long term treasuries paid more than money paid to depositors.

But even then, there was a 🚩. SVB put nearly 50% of their assets in treasuries and mortgage backed securities!! No prudent financial firm should ever invest their clients’ funds in such a concentrated bet.

And then. In 2022 came the Fed’s rate increases. First slowly and then quickly. Which lead to 👇

Yield curve inversions

This treasury bond investing strategy carried serious risks in 2022, when the Fed and economic uncertainty inverted the yield curve. This caused two problems: 1) Current bond purchases declined in value because new bonds had higher yields and 2) The market demanded much more immediate return for monies lent.

For a while everyone behaved as though rising rates were very temporary. Banks had the luxury of putting money in higher yielding assets while paying customers relatively little. The net interest income stayed positive.

Meanwhile, one of the safest investments in the world, a US Treasury and other bonds declined throughout 2022. The value of older bonds plummeted as new government bonds provided higher yields. By the end of 2022, this was no longer a secret. US banks had already booked $620 billion in unrealized losses!

How were they unrealized? The held-to-maturity accounting standard allows banks to avoid stating losses on holdings. Defined as “positive intent and ability to hold [securities] to maturity are classified as held-to-maturity [HTM] securities,” it makes sense in a normal normal environment. Even if there are losses in a bond at some point, the bond will reprice to par (100%) at maturity.

Banks and investors were holding on to hope until maturity. The unrealized losses would reverse when everything eventually gets better. But what they really banked on (pun intended) was that banks would not be forced sellers. Which is only possible as long as customer didn’t ask for their deposits back.

It seemed that was possible. The dream continued 👇

For a Moment Things Seemed Under Control…

“There are no implications for SVB. Let’s keep the dream alive.”

Silicon Valley had its earnings report in January. And the stock went up 43%!

When asked about underperforming bond holdings and associated unrecognized loss in Q1, the SVB Chief Financial Officer Daniel Beck told investors there wasn’t “any desire” for a wholesale [accounting] change. This matched a sentiment he shared in November: “There are no implications for SVB because, as we said in our Q3 earnings call, we do not intend to sell our HTM securities.”

Up until the end of February, the issues were known but everyone seemed happy with these explanations. No crisis of confidence.

EXCEPT…

There was still the pesky issue of SVB holding 50% of its assets in treasuries and mortgage-backed bonds that were declining in value.

And start-up customers were 🔥burning more and more cash 💸. Withdrawals started to stream out. But SVB execs thought “it is only a small stream, it is manageable right?”

And Then The Unexpected Happened…

The thing about stress is that is all seems manageable until it isn’t.

Customer cash burn and withdrawals became a serious concern. A stream became a raging river. 🌊

The pressure was serious enough for SVB to finally repair its financials as outlined in this deck and an accompanying press release. From the capital raise deck:

In fact Silicon Valley had no choice in the matter. Moody's, a leading rating agency, was about to issue a worrying credit report highlighting the company’s vulnerable financial position. SVB couldn't find a secured source of funding in time and instead issued the press release ahead of Moody's.

SVB was sitting on an explosive situation. 🧨

The press release kicked off a nuclear chain reaction ☢️ made worse by:

🚩 Poor timing. Just earlier in the week Silvergate, a crypto-focused bank, shutdown because it didn’t have enough assets to meet withdrawal demands. Also, US bank stocks had come under pressure after KeyCorp warned about mounting pressure to reward savers with higher rates for deposits. Could SVB have waited a few days?

🚩Terrible communication strategy. The press release SVB was both unexpected and lacking in detail. It lacked PR strategy and context. Nervous customers were left wondering why SVB needed money? SVB declined to comment beyond the release. People are were frazzled. On went the chain reaction.

🚩 An accounting approach gone terribly wrong. The moment SVB had to sell the bonds, they had to abandon the hold-to-maturity mirage. Panicked customers were shocked to see a sudden $2 Billion hole in the balance sheet. Where did this come from?

🚩Highly concentrated customers base. Confused and scared, the start-up community approached the problem, as well, one united community. Nervous clients who’s assets far exceed the maximum insured ($250k) by the FDIC read last and acted first. The frantic mob of start-ups broadcasted withdrawals and warnings on social media. Fear went viral. SVB had lost its customers.

Which Lead to the Unthinkable

Moody’s Investors Service cut the bank’s issuer ratings following the fateful press release.

SVB tried to raise capital but failed and FDIC jumped in to save deposits.

On March 9, the bank had enough to meet the needs of depositors. On March 10th, the bank was insolvent with a negative cash balance of about $1 Billion. Customers demanded withdrawals of nearly $42 Billion in this much time!

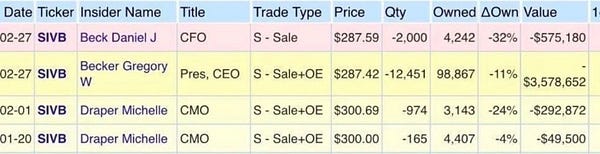

Now questions are swirling whether the C-suite knew and sold shares ahead of time.

I am inclined to say they knew times were tough and sensed no immediate relief in sight. However, I don’t think anyone could have forecasted an unprecdented 24 hour bank failure.

What Does This Mean For Us?

“Next week is impossible to position for,” said Jim Bianco of Bianco Research. “What stocks want is no contagion and the Fed to back off the hiking. They will get one or the other, not both.”

Updated: 3/14 2:20pm

Regulatory Response Thus Far

Janet Yellen and the Fed announced on Sunday 3/12 that SVB will not be bailed out. The government returned all money for depositors. Shareholders were wiped out. The government is still trying to sell the bank but it looks like components of the business will be sold piecemeal.

The joint solution from Fed, Treasury, and FDIC seems to have calmed the markets. Will it be enough to maintain the trust? 🤞

The Fallout Zone

Public firms seemed to have survived with no scars. The impacted firms also included Circle, an important backbone of the crypto ecosystem. Here is a list.

Signature Bank was also shutdown as they faced a similar bank run on Friday 3/10.

First Republic, Western Alliance Bancorp, PacWest Bancorp have experienced massive drops in share prices until 3/13 because of concerns on the fair value of hold-to-maturity securities on their balance sheet.

Charles Schwab has experienced a scare in its investor base and a drastic drop in their stock price. They have come out with press releases that they are not a traditional bank and have a healthy mix of insured and uninsured clients along with a healthy balance sheet.

What’s Been Seen, Can’t Be Unseen

Many uncomfortable truths have emerged and we will write a post-analysis piece. The scrutiny following this disaster has shined a light on some uncomfortable truth and more are emerging every day. How will the economy adjust to these?

👉🏽 Who will be willing to bank startups carte blanche? Start-up clients come with considerable risk and are struggling in a tough environment. As Shelf’s co-founder mentioned, SVB offered services not available elsewhere.

👉🏽 Start-ups need talent…it is their oxygen (along with capital). With this financial distress, the calculus of working at a start-up just became considerably more uncertain for employees. Will this impact their ability to retain talent?

👉🏽 Smaller and mid-size banks are potentially sitting on large losses that have been ignored thus far. How will we navigate these going forward?

👉🏽 Start-ups still have not adjusted to economic reality. SVB pointed out that "cash burn levels have not adjusted to a slower funding environment”. Firms will need to adjust with more fiscal responsibility to survive.

👉🏽 And the biggest question on everyone’s mind. Something finally broke. Does the Fed have the data now to cut interest rates?

If you have any questions, leave a comment. Thanks for reading Embrace the Chaos! Sharing perspective that makes sense.

- Vikas Kalra, CFA