China Unravelling. Lessons From 45 million Potato-Related Deaths.

Pigs and other troubling indicators of the Chinese Economy

Happy summer to everyone. We are entering what feels like a period of increased instability. I will post shorter and more frequent posts for the rest of August as some situations are developing rapidly.

China sounds like the country version of Enron lately. First it started with pigs. Yeah pigs. They are an important part of the Chinese economy! That important. We will get to that.

Pigs aren’t the only things in decline. Now we have companies and industries splintering into bits. China’s used to export goods, now they seem to export the apocalypse. First COVID and then inflation. Now deflation (recession)?

The economy is crumbling. The lender of last resort was and still is the Chinese government. Can the government heat up the economy and get it moving again? Can they plug the gap? Does the Chinese economic freeze turn from a snowball into an avalanche?

Even with a diminished US relationship, China is still a huge player in the global economy. China, once the world’s growth engine, is slipping into an abyss of its own design. Does it take the world with it? Or can we all get on fine without China?

How We Got Here. What Pigs Tell Us.

The China Miracle was fueled by:

Government spending on infrastructure, real estate, and technology

Ingenious and ambitious labor as rural populations moved to the urban centers.

The American and global consumer. China was and the world’s workshop.

Corporate investment in China as a growing trading partner with the US and Europe.

Optimism inside and outside of China

The Chinese Unravelling is driven by the end of all of these sources of business and liquidity. The music is slowing down:

Xi and the Communist Party have aggressively chased down company chiefs with too much power. Jack Ma, the poster child for too big, disappeared for nearly a year.

The National Communist Party is not bailing out local provinces which are heavily indebted due to the collapsed real estate boom.

The world has found new workshops. Mexico has overtaken China as the US’s biggest trading partner! By $22B.

There is severe inequality in China. Communism is supposed to provided economic equality. The promise of a bright future has dimmed (as evidenced by last week).

Since the beginning of the year, foreign firms have been marching out of China as the CCP puts on pressure with government controls, anti-spying laws, and other seeds of distrust.

The one child policy is catching up with China’s future as the population ages faster than most countries. In 20 years, there will be more people over 60 in China than the entire US population! Which also means debt and support burdens are crushing China’s economics.

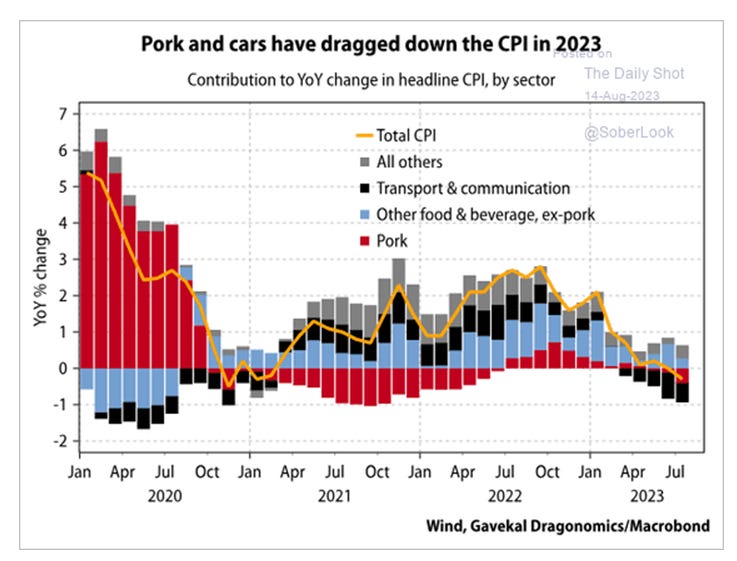

A popular indicator of consumer spending is pork demand. And its drop this year has everyone concerned. Chinese consumers are in a troubled situation if they pullback pork consumption.

The Potato Famine

2023 reminds me of the Chinese historical debacles illustrated by Charles Mann in 1493. A very, very quick history first. Ireland was not the only country that relied on the mighty potato. The potato, a product of South America, was exported by Spain as it colonized the New World. The potato was transformative and potent. Potatoes are packed with calories and sustenance, proved hearty and cheap, and grew just about anywhere. As a result, the potato took China by storm as entire cities were able to grow with the power of the potato.

Fast forward to the Communist revolution and Mao’s Great Leap forward in 1950s and 1960s. Overzealous and inexperienced communist youth spread throughout the countryside commanding and teaching “lowly” farmers the best agricultural techniques of the day. It was an unmitigated disaster. 40-50 million people died.

From the Tombstone book review by the Guardian:

During the Great Leap Forward, Mao and his leadership colleagues took specific decisions that led to mass starvation. They perpetuated a system that encouraged people to tell lies about grain production and discouraged transparency, making starvation worse.

And more examples of hubris and incompetence by the Carnegie Council:

The sad truth is, however, that only planned human intervention could and did manage such a thorough going, nation wide disaster. In every province misguided Party zeal and amateurism prevailed over both agricultural science and old peasants' wisdom. Indiscriminate application of the methods of intensive cultivation (deep plowing, close planting, and heavy fertilization), under the supervision of inexperienced young cadres, produced catastrophic crop failures even in the normally fertile rice paddies of South China. Ill-conceived projects, undertaken to irrigate the dry wheat-growing plains in North China in order to convert them into high-yielding rice paddies, led to fatal alkalinization of large areas of arable land.

What does this have to do with today? Similar patterns of bad planning and misguided superiority are at play at a national scale.

A Blizzard of Bad News

In the last 2 weeks, every shred of news from China has been bad to worse. Economic health is a matter of confidence. Confidence is the currency of credit. Credit is oxygen for any financial system.

China is approaching life support status. Some eye-catching news (🤧 highlights contagion risks to other countries):

Bank loans slid to a 14-year low.

Consumer and producer prices both declined.

Exports slid the most since February 2020.

China Evergrande Group, on Thursday filed for bankruptcy protection in New York. Why does a Chinese company file for protection in the US? Because the crisis impacts US investors and could spill over to the financial system (🤧).

Country Garden Holdings Co., formerly the nation’s largest developer by sales, has tumbled amid concern over its liquidity. Blackrock, Fidelity, and Allianz all hold positions (🤧).

Two clients of trust company Zhongrong International Trust Co. said Friday the firm had delayed payment of maturing wealth products. The bigger problem is that Zhongrong is linked to the Zhongzhi Group, one of China’s largest private conglomerates with operations in financial services, mining and electric vehicles. (🤧). This also puts a severe dent on credibility in the Chinese asset management sector.

The People’s Bank of China surprised the markets with a rate cut as confidence in its economic recovery dwindled. It cut its overnight seven-day and one-month standing lending facility by 10 bps each.

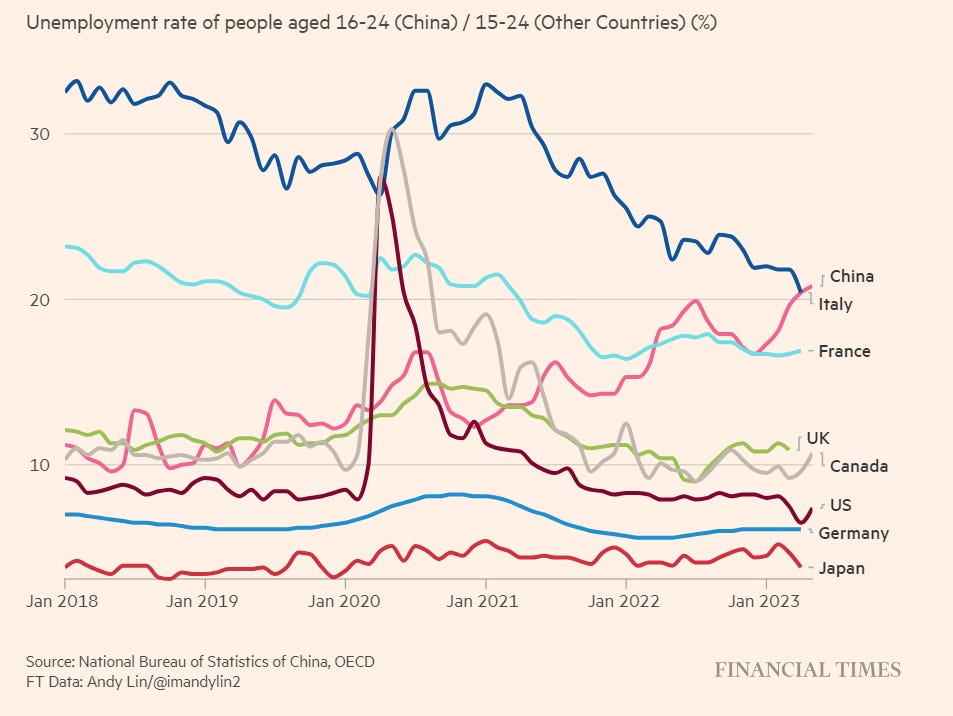

The country’s record youth unemployment is skyrocketing! In June it was 21.3%. It is so bad the government is hiding it all. They stopped releasing data on it as it “reworks” its calculation. That is higher than every other G7 country and devastating for the optimism that Xi relies on.

What Next? Why Everyone Should Care.

On Monday, Beijing will release the latest monetary policy decision on its one-year and five-year loan prime rates - the benchmark for commercial banks to price loans.

Will China push a major stimulus to revive China’s economy? Will it be good enough for the markets after this tailspin the Chinese markets have been for the last few weeks?

This will have an impact on the markets. How bad is the unknown. Can it be controlled? Who does it impact? For example, one of America’s largest managers, Blackrock is already under scrutiny over its large investments in China.

What is most concerning is that Xi seems to be living in a fantasy world like Mao during the Great Leap forward. He is still grasping at grand visions about building a dream city while the country chokes.

Repeating the potato famine mistakes, China has created its own mess again due to ego, xenophobia, delusions, and poor forecasts of demand. An Australian think tank, the Lowy Institute, said:

Digesting the financial consequences of over investment in infrastructure and the failure to offset the slowing growth in external markets with growing domestic markets lie behind China’s growth slowdown. Unlike many countries in the grip of inflation, China has too much capacity, and not enough demand.

Like COVID, there are many paths for an economic contagion to spread if the Chinese state can’t stabilize the situation. The state has managed to creatively prop up its markets before but it is running out of options with every new economic flop.

The largest threat to China is an exogenous climate-induced event which drains the state’s economic and social capital. Think drought, floods, or another COVID-like scenario. This situation warrants watching 👀.

If you have any questions, leave a comment. Thanks for reading Embrace the Chaos! Sharing perspective that makes sense.

Much effort and research went into making this 7-minute read. If you found it insightful, please help me out by clicking the like button and sharing this article.

Sharing is caring!

- Vikas Kalra, CFA

An excellent report on China. Will be very helpful for investors to make decisions.